What is Bitcoin?

The History & Emergence of a Modern Money Technology

I remember back in 2020 when I was first Orange Pilled, as the saying goes – my mind cracked open to the exponential opportunities that the world of cryptocurrency afforded.

4 years ago I was trapped inside my house, like many of us – confused by what was going on in the world. Before I knew it, the Covid-19 pandemic swept across the country forcing us into lockdown.

While trapped at home, I took the time to self educate with new ideas via the magic of the internet. Basically, I watched a lot of youtube and listened to a lot of podcasts… and still do (sue me).

Then I discovered Bitcoin via one of those personal finance podcasts that I was listening to at the time. I was confused by it at first, skeptical even, but most of all…

I was curious.

I wanted to learn more — and so, down the rabbit hole I fell.

What to expect from today’s letter

What is Money 101 & Quick Historical Overview

The Emergence of Bitcoin

Bitcoin in Relation to Fiat Currencies

How Bitcoin is Gaining Legitimacy Today

TL;DR (Too Long; Didn’t Read) – Recap on Bitcoin

What is Money?

I won’t go too deep down this rabbit hole – on the lengthy history of money – because that could be a whole article on its own. I will, however, give you some context to briefly explain what Money is and how it’s evolved in society over the years.

Money has 3 essential functions:

A Medium of Exchange: Money should facilitate transactions efficiently and be widely accepted as payment for goods and services.

A Store of Value: Some forms of money may be better suited for preserving wealth over time due to their intrinsic properties, scarcity, or stability. For example, precious metals like gold have been historically valued for their durability and limited supply, making them effective stores of value.

A Unit of Account: Money serves as a common measure of value, allowing for the comparison of prices and the accounting of economic transactions.

Over centuries, money has taken various forms, reflecting the evolution of human civilizations and the needs of societies. In ancient times, people went from bartering livestock, shells, and grains to eventually trading metal coins like silver and gold.

As society grew more complex, the concept of money had to adapt to be more portable and universally recognized for the needs of civilization. This is when we saw the rise of government backed paper currencies – a.k.a. Fiat Money.

Fiat money is a government-issued currency that is not backed by a commodity such as gold or silver. Instead, its value is based on the public's trust in the government or central bank that issues it.

In the present day United States, money primarily exists as electronic digits in bank accounts, physical bills, and coins – the US Dollar as you know it. It is backed by the trust and stability of the government, with the Federal Reserve (a centralized banking authority) regulating its issuance and value.

This fiat based money system is flawed. Full Stop.

Why? In short, a fiat currency system that can be manipulated and devalued over time by government agencies has ~historically~ always been destined to fail.

But let’s save that rabbit hole for another time.

Enter, Bitcoin.

The Emergence of Bitcoin

Bitcoin is a digital currency that has captured the imagination of millions around the globe. But what exactly is Bitcoin, and why does it matter?

Bitcoin, often dubbed “digital gold,” is a global, decentralized cryptocurrency invented in 2008 by an anonymous person or group known as Satoshi Nakamoto. Its creation was spurred by the desire to establish a Peer-to-Peer electronic cash system that operates WITHOUT the need for 3rd party intermediaries like banks or governments. (And no… not like Venmo, Zelle, Cash app, etc)

Unlike traditional currencies, which are controlled by central authorities, Bitcoin operates on a decentralized network of computers, using blockchain technology to record transactions. This makes it resistant to censorship, fraud, and manipulation.

One of Bitcoin's most intriguing and well known features is its FIXED supply. There will only ever be 21 million bitcoins in existence, a limit coded into its protocol at inception. Every four years, a process called the "halving" occurs – reducing the rate at which NEW bitcoins are created (this is known as Bitcoin Mining).

Bitcoin Mining is a process by which miners can get rewarded with new Bitcoins by doing work (computers solving cryptographic math problems) that validates transactions and keeps the network secure.

The current Bitcoin mining reward is 3.125 BTC per block, and it shrinks by half roughly every four years. (Last Halving occured 4/20/2024)

The Halving of new bitcoin supply is designed to mimic the scarcity element of precious metals like gold, making Bitcoin a potential hedge against the debasement of currency & economic uncertainty.

Currently there are about 19+ million bitcoin circulating in existence today, & the very last bitcoin is set to be mined sometime in the year 2140.

But what does this all mean? Cool, now we have digital money people can gamble on.

Who cares?

Bitcoin in Relation to Fiat Currencies

Before moving on, I want to define 2 concepts: Inflation vs Debasement

Currency Inflation is the gradual INCREASE in the prices of goods and services over time. Many of you know about this and can see this happen in your own lives. That burger ‘n fries order get pricier every year!

Currency Debasement, however, is the DECREASE in the VALUE of a currency over time due to the INCREASE in its supply. (This is a sneakier way governments’ steal the purchasing power away from its citizens)

Bitcoin's historical importance in relation to the debasement of fiat currencies lies in its emergence as an alternative form of money that is not controlled by any government or central authority. This is a BIG IDEA💡, and somewhat of a controversial idea.

Fiat currencies, like the US dollar or the euro, are issued and regulated by governments and central banks. Throughout history, governments have engaged in practices like printing more money (a process known as quantitative easing), which can lead to INFLATION & DEBASEMENT of the currency. Additionally, governments may manipulate interest rates and engage in other monetary policies that impact the value of their fiat currencies.

Okay, pause.

It seems pretty unfair that the citizens of a country can get their savings slashed in value because of their own government’s financial irresponsibility! Seriously, WTF?!

Bitcoin, on the other hand, operates independently of any government or central authority. Its supply is limited to 21 million coins, which makes it immune to inflation caused by excessive money printing. The decentralized nature of Bitcoin means that no single entity can control it or manipulate its value. This has led some people to view Bitcoin as a hedge against the potential devaluation of fiat currencies. (this should be a lightbulb moment for everyone) 💡💡💡

How Bitcoin is Gaining Legitimacy Today

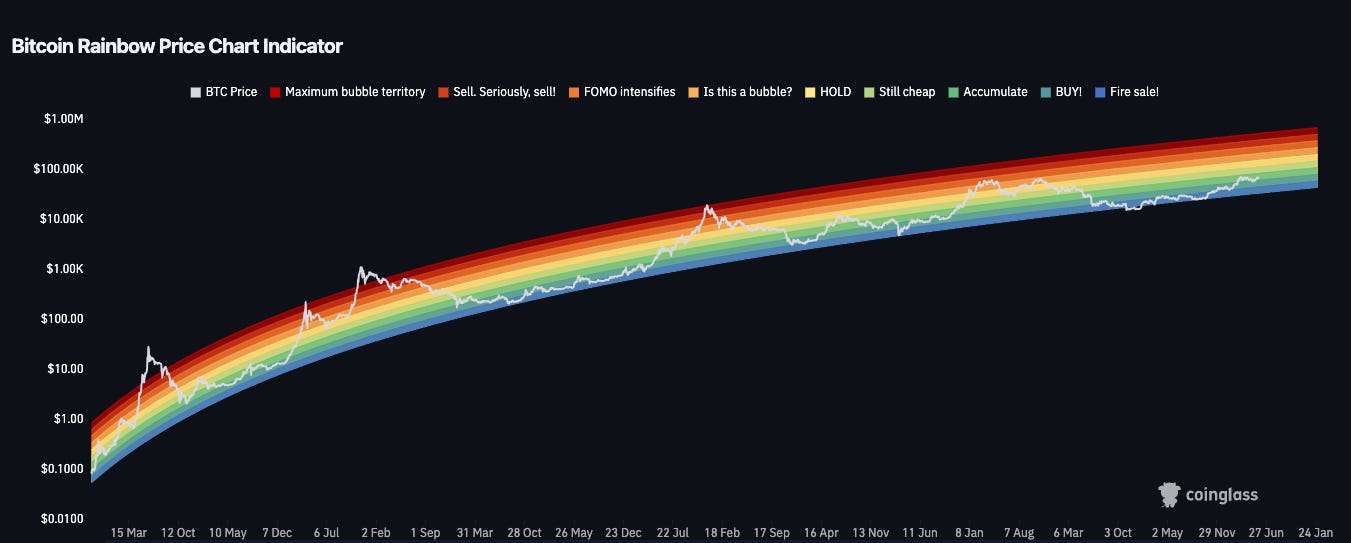

Since its inception, Bitcoin has experienced volatile price fluctuations, characterized by dramatic highs and lows over 4 year cycles. However, over the long term, its value has shown remarkable growth, attracting both investors seeking high returns and individuals looking to preserve wealth in times of economic instability.

As we navigate through the current state of Bitcoin, it's essential to recognize its growing acceptance and adoption. Major companies, institutional investors, and even governments are increasingly recognizing its potential as a legitimate asset class and a hedge against traditional financial systems' risks.

The recent approval and trading of a spot Bitcoin ETF (exchange traded fund), has only driven more credibility to the maturation of this asset, and the greater crypto asset class as a whole.

While Bitcoin's journey has been marked by controversy and skepticism, its underlying principles of decentralization, scarcity, and security continue to fuel its resilience and relevance in an ever-changing digital world.

TL;DR (Too Long; Didn’t Read) on Bitcoin

I know this letter was a bit beefy with information. But if you are wanting to get the “sparknotes” on what Bitcoin is, then see the key highlights below on the merits of Bitcoin as a Money:

**Limited Supply: Bitcoin's supply is capped at 21 million coins. This scarcity is built into its code, unlike fiat currencies, which can be printed at will by central banks. This limited supply makes Bitcoin immune to inflationary pressures caused by excessive money printing.

**Decentralization: Bitcoin operates on a decentralized network called blockchain, which is maintained by a distributed network of nodes (computers). This means that no single entity, such as a government or central bank, can control or manipulate Bitcoin. Its decentralized nature makes it resistant to censorship and interference.

**Global Accessibility: Bitcoin can be accessed and transacted with anywhere in the world, as long as you have an internet connection. This makes it attractive for individuals living in countries with unstable currencies or limited access to traditional banking services.

**Divisibility and Portability: Bitcoin is highly divisible, meaning you can buy and sell tiny fractions of a Bitcoin. This makes it accessible to people with different levels of wealth. Additionally, Bitcoin is digital, so it can be easily transferred and stored in digital wallets, making it highly portable.

**Growing Acceptance: Over the years, Bitcoin has gained acceptance as a form of payment by an increasing number of merchants and businesses. This growing acceptance adds to its legitimacy and utility as a medium of exchange and store of value.

**Investor Demand: With the approval & launch of the Bitcoin ETF, the increasing interest from institutional investors, hedge funds, and corporations has contributed to Bitcoin's price appreciation. These investors view Bitcoin as a hedge against inflation and a diversification tool for their investment portfolios.

If you want to learn more about Bitcoin, read the Whitepaper Here!

Phew, that's it for today! I know it was a long one. Hope I was able to Orange Pill you 😉

Let me know what you think! Leave a comment down below if you read this far

In future editions of this newsletter, we will delve deeper into the intricacies of Bitcoin and cryptocurrency ecosystems, exploring their impact on finance, technology, and society at large.

Stay tuned as we unravel the complexities of this fascinating Digital Renaissance.

High level overview 💎 we choosing rich

Very informative! And sick meme dude 😎